Net Zero Energy: A Plan to Electrify Low to Moderate-Income Homes

The Challenge

Tackling the climate crisis will require an economy-wide approach, reaching every business, every home, and every family. The good news is that we have the technological know-how to foster a carbon-neutral future: solar, wind, and other renewable sources, combined with battery and other storage technologies, can power an “electrified” economy, with more and more appliances, vehicles, HVAC systems, cooktops, and other equipment running on green electricity. Unfortunately, climate change mirrors other injustices in America and around the world: environmental degradation disproportionately impacts communities of color, women, immigrants, and Indigenous peoples. Absent a deliberate and thoughtful plan, these communities will be left behind—unable to benefit from the upsides of a greener economy while continuing to suffer from the old, dirty system.

A 2019 study found that “census tracts that are over 50 percent black or Hispanic have ‘significantly less’ rooftop solar installations than census tracts with no majority or that are majority white.” At the same time, homeowners who are of color and / or low to moderate-income (“LMI”) are more likely to suffer from poor indoor air quality; to live in unsafe conditions due to asbestos, mold, knob-and-tube wiring, and other hazards; and to pay a higher percentage of income on utilities as a result of inefficient HVAC systems, appliances, and building envelopes. LMI families looking to make green improvements in their homes face several barriers, including:

1. An inability to access affordable loans due to poor credit, mistrust of the financial system, racism, a lack of home equity, lenders being uninterested in financing small projects, etc.

2. A lack of reasonably priced contractors who specialize in all facets of electrification forces homeowners to become experts in green technology

3. The difficulty of understanding the universe of options—solar PV, solar hot water, heat pumps, high-efficiency boilers, geothermal—for going green.

The Opportunity

A well-designed electrification program can, at scale, enable millions of homeowners to save money, increase the value of their homes, and improve indoor air quality and safety. In fact, according to a recent report by Rewiring America and the Coalition for Green Capital, a national electrification program “has the potential between now and 2030 to secure energy bill savings of up to $750 per year for nearly 12 million American households (75 percent of which are LMI), while at the same time creating over 700,000 jobs and driving down household greenhouse gas emissions by nearly 40 million metric tons a year.”

A lack of access to affordable capital, combined with redlining, de facto segregation, and other historical and ongoing injustices, has resulted in a lower-quality housing stock for LMI families and made it harder for these families to finance needed improvements. To create a Net Zero program—which we define as an initiative that strives to get household emissions as close to zero as possible while structuring the financing so that the monthly savings is equal to or greater than the debt service—several elements are essential:

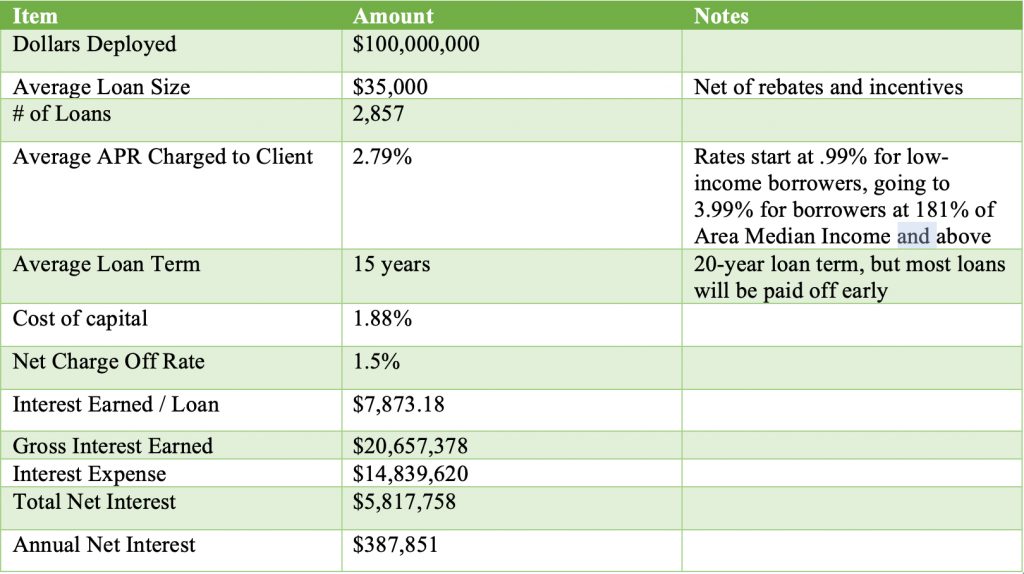

1. Financing must be made available to LMI borrowers at low rates and with long terms, so that the energy savings outweigh the debt service cost. For example, if an average family spends $2,500 per year on heating and cooling and the average electrification project costs $35,000 (net of rebates and tax credits), then a Net Zero loan would need to carry a maximum APR of 3.5% and a term of roughly 20 years.

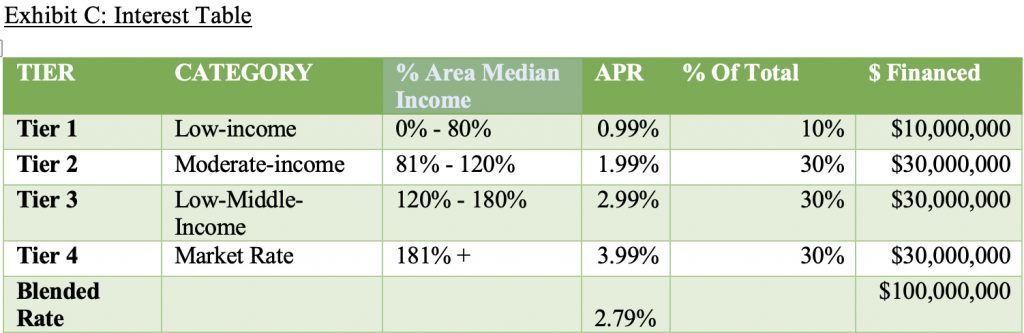

a. To ensure radical equity in the program, the interest rate will be tied to income: the lower the income of the borrower, the lower the APR. See Exhibit C for a detailed rate table

2. To offer Net Zero loans at 3.5% for 20 years, the lender must secure flexible, long-term capital at a blended cost-of-funds of roughly 1.88% (assuming a 1.5% net charge-off rate)

3. A robust network of contractors must stand ready to do the work. These contractors must:

a. Offer a turnkey solution, so that homeowners needn’t interface with a separate solar, HVAC, water heater, and insulation installer / contractor

b. Have an understanding of the community so as to build trust, reach families, and explain the benefits of electrification

c. Create a simple, easy-to-understand, frictionless, and user-friendly experience, from inquiry through to project completion

The Proposal

Capital Good Fund (“Good Fund”), a nonprofit, U.S. Treasury-certified Community Development Financial Institution that specializes in small-dollar personal loans for LMI families, seeks to launch two entities to run a $100 million pilot program that will electrify 2,800 homes. This program will be closely aligned with Good Fund’s mission to create pathways out of poverty and advance a green economy through inclusive financial services: we have always worked at the intersection of economic and racial injustice, climate change, and predatory lending. Since our founding in 2009, we have closed 7,300 loans for $14.7 million (with a 95% repayment rate), of which 535 loans for $4.5 million have been specifically for energy-efficiency upgrades (with a 99.4% repayment rate).

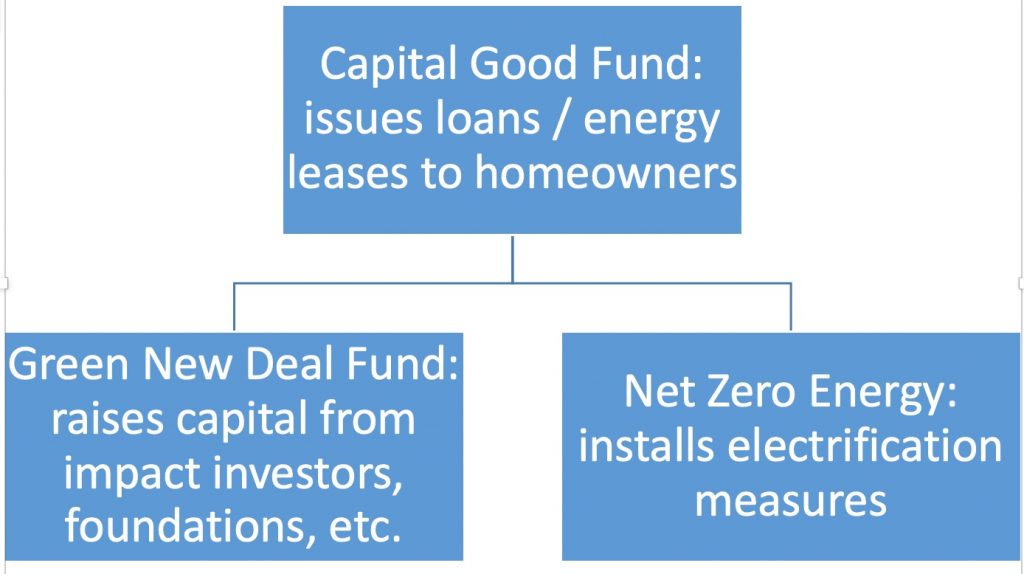

The first entity, the Green New Deal Fund (“GNDF”) will raise $100 million in low-cost, long-term capital to finance the 2,800 projects; Good Fund will use this capital to issue financing to homeowners for the electrification work. The second entity, Net Zero Energy (“Net Zero”), will be a for-profit subsidiary to Good Fund that will provide turnkey electrification services to homeowners ranging from solar PV and battery backup system installation, to heat pump-driven HVAC and water heaters, home EV charging stations, induction cooktops, insulation, and home health and safety measures. Exhibit A illustrates the relationship between GNDF, Net Zero, and Good Fund.

Green New Deal Fund

While the structure is still to be determined, there are several possible approaches. Two options that stand out are:

1. A traditional debt fund, into which investors make loans. These notes could be offered via a nonprofit private placement, such as a 506c offering that allows the notes to be marketed in all 50 states (albeit limited to accredited investors). Under this structure, Good Fund would be engaged to originate, underwrite, and service a pool of loans for GNDF

2. A Limited Partnership or Limited Liability Limited Partnership into which investors make equity investments. Under this structure, investors would come in as limited partners and Good Fund would be the general partner.

Regardless of the legal structure of the fund, to secure a blended cost of funds of 1.8%, GNDF will use an integrated capital approach. For example, under a traditional debt fund there could be three tranches of capital:

• An entity like the Community Guarantee Investment Pool, or another foundation / donor (or combination of funders), would guarantee the first 5% of losses ($5 million)

• Investors in a second-loss position (after the guarantee pool), would earn a rate of 3.5%. $35 million would be issued at this rate

• Investors in a third-loss position would earn a rate of 1%; we would issue $65 million at this rate. In order for these investors to have any principal at risk, the overall net charge-off rate would have to be 40%. Therefore, in exchange for almost zero risk, the investor would earn a more modest return

• This model yields a blended cost of funds of 1.88%

• A simplified financial model can be found in Exhibit A

Net Zero Energy

Net Zero will be a for-profit subsidiary to Good Fund, with the nonprofit having the majority of voting shares so as to retain control over the mission. Net Zero will seek certification as a B Corp and incorporate equity into every aspect of its operations. A primary focus will be diversity—from the Board to senior management and frontline workers—as well as offering generous salary and benefits, excellent working conditions, and a means by which employees can obtain shares or profit-interests in the company. Investors in Net Zero will receive a limited return on their investment, with the understanding that generating market-rate returns is incompatible with a mission-first entity that serves marginalized communities, hires from those communities, and creates good-paying, upwardly mobile employment opportunities. Determining the specific rate of return for investors in Net Zero will require further modeling, which we hope an Advisory Board will help us with (see “Next Steps” below).

While Net Zero’s CEO will be Capital Good Fund’s Founder and CEO, Andy Posner, day-to-day operations and management will be led by a person with deep experience in the solar, HVAC, and / or weatherization field, along with an experienced team of marketers, web and database developers, customer service representatives, and installers.

Fundamentally, the idea is to allow for vertical integration, with the combined family of entities—Capital Good Fund, Green New Deal Fund, and Net Zero Energy—controlling every aspect of the electrification process, from raising capital, to marketing, financing, installation, and customer follow-up. This vertical integration, occurring under the aegis of a Community Development Financial Institution with a twelve-year track record, ensures that the mission of the initiative—to address climate change while reversing economic and racial inequality—is protected and indeed remains front and center. We are unaware of another model such as this, and, after a successful first deployment of $100 million in projects, the program could scale to $1 billion and beyond. Given the scope of the climate crisis, the need and potential for the program is orders-of-magnitude greater.

Next Steps

We are seeking to create a top-notch Advisory Board to assist with the creation of a business plan for Net Zero Energy, identifying potential investors in both Net Zero and the Green New Deal Fund, and determining the best structure for GNDF. Given the urgency of the moment, we are looking to complete a draft business plan by September 1. Concurrently, we will begin to reach out to potential investors, funders, board members, and partners—including municipalities, community colleges, job training providers, solar and HVAC manufacturers, community groups, and other key stakeholders. We wish to be ready to begin our first electrification project in January / February 2022.

Exhibit A: Simple Financial Model for Loan Fund

Exhibit B: Relationship Between Entities

The following illustrates the relationship between the nonprofit lender, the issuer of low-cost debt, and the provider of turnkey electrification work:

Exhibit C: Interest Rate Table

Leave A Reply